tax on unrealized gains yellen

If so this would be a major hit to anyone who invests and tries to preserve wealth. Our team of tax experts are ready to tackle your questions.

Instagram Economics Idiots Rich People

Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical plan and could hurt.

. Political Commentators Libertarians Crypto Enthusiasts Scorn Yellens Proposal Tax on Unrealized Gains Is Legal Plunder The 2020 Libertarian vice presidential candidate Spike Cohen said This is unconscionable. Treasury Secretary Yellen proposes a tax on unrealized capital gains to finance Bidens Build Back Better plans. The current rate in the US is up to 37 based on the asset type period of holding and the income of the investor.

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. The plan will be included in the Democrats US 2 trillion reconciliation bill. Do you think theres a chance this actually happens.

Yellen wants investors to pay a tax on the increase in value of their stock every year even if it isnt sold. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. National Investment Income Tax 38.

Appreciation would reportedly be taxed at the same rate as all other income - up to 37. California long term capital gain rate 133. Yellen Describes How Proposed Billionaire Tax Would Work.

Treasury Secretary Janet Yellen is currently considering some shocking policies. Political Commentators Libertarians Crypto Enthusiasts Scorn Yellens Proposal Tax on Unrealized Gains Is Legal Plunder The 2020 Libertarian vice presidential candidate Spike Cohen said This is unconscionable. Total long term capital gain rate 567.

It doesnt take a genius to realize how stupid this is and how difficult it would be to actually implement. Federal long term capital gain rate 396 BidenYellen proposal v 20 today. Bidens newly appointed US.

However none of the videos currently in circulation appear to show exactly what Yellen had to say on the subject. Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35. Its not a wealth tax but a tax on unrealized capital gains of exceptionally wealthy individuals US.

BeInCrypto The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. NEW US. Wyden and his staff have been working on the idea for two years but they havent released.

Apparently Janet Yellen has been floating the idea of an unrealized capital gains tax. That sounds good until you realize that 100000 increase was an unrealized gain. Treasury Secretary Janet Yellen told CNN on.

For those who dont know an unrealized gain is when something you own gains value but you dont sell it. President Biden Unveils Unrealized Capital Gains Tax for Billionaires. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter.

Biden Admin Proposes Tax On Unrealized Capital Gains Economist Matt Will Says The Damage It Would Do Is Incalculable Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealized capital gains. Federal long term capital gain rate 396 BidenYellen proposal v 20 today. For those who dont know an unrealized gain is when something you own gains value but you dont sell it.

Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35 trillion. Ad Connect with our CPAs or other tax experts who can help you navigate your tax situation. A Texas resident would see the following taxes.

Speaking to CNN on Sunday the former Federal Reserve chair said the measures would target liquid assets held by extremely wealthy individuals. Political Commentators Libertarians Crypto Enthusiasts Scorn Yellens Proposal Tax on Unrealized Gains Is Legal Plunder The 2020 Libertarian vice presidential candidate Spike Cohen said This is unconscionable. Instead of paying taxes when you finally sell your home or cash out your 401k or trade stock you would be taxed on the subjective made-up unrealized value gain right now.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. The tax on unrealized gains faces hurdles.

And if you dont pony up for Janet Yellens salary the government is coming for you. 24 2021 125 pm ET. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains.

Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. 24 2021 626 pm ET Original Oct. Secretary of the.

Government coffers during a virtual conference hosted by The New York Times. File with confidence now. Treasury Secretary Janet Yellen has revealed that the US.

Capital gains tax is a tax on the profit that investors realize on the sale. Capital gains tax is a. Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain.

For those who dont know an unrealized gain is when something you own gains value but you dont sell it. What Yellen the former Chair of the US Federal Reserve has proposed is that. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2.

Us Government Unrealized Gains Tax Plans Might Hit Crypto 039 Billionaires 039 Too In 2021 Bitcoin Currency Wealth Tax Capital Gains Tax

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

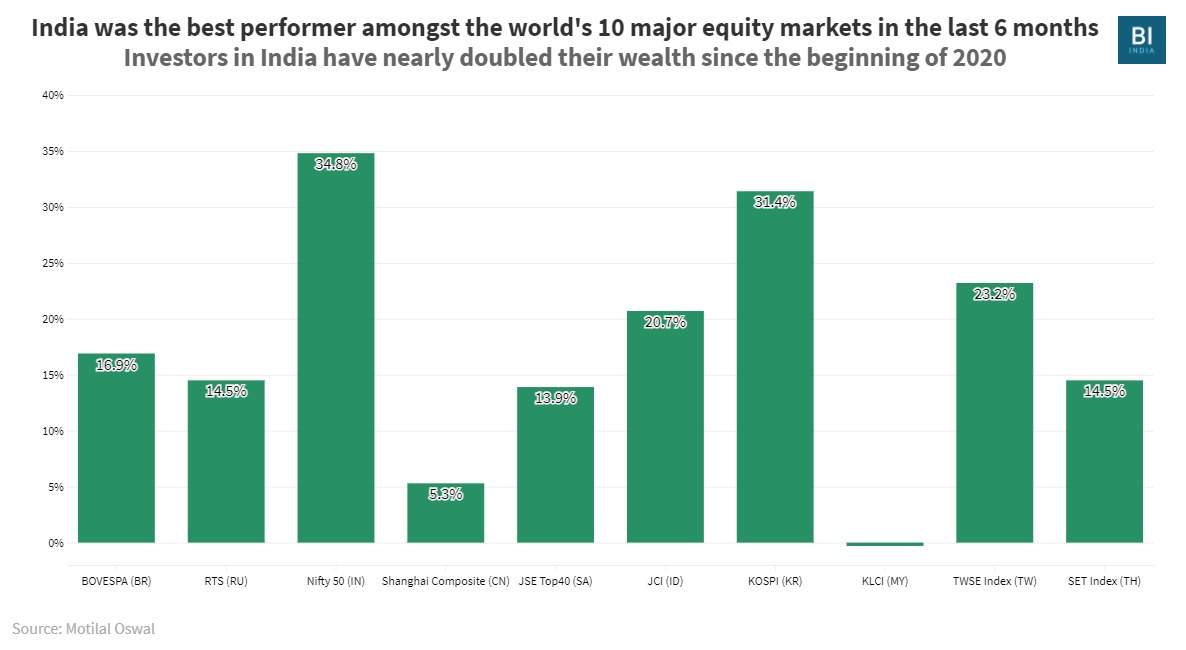

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

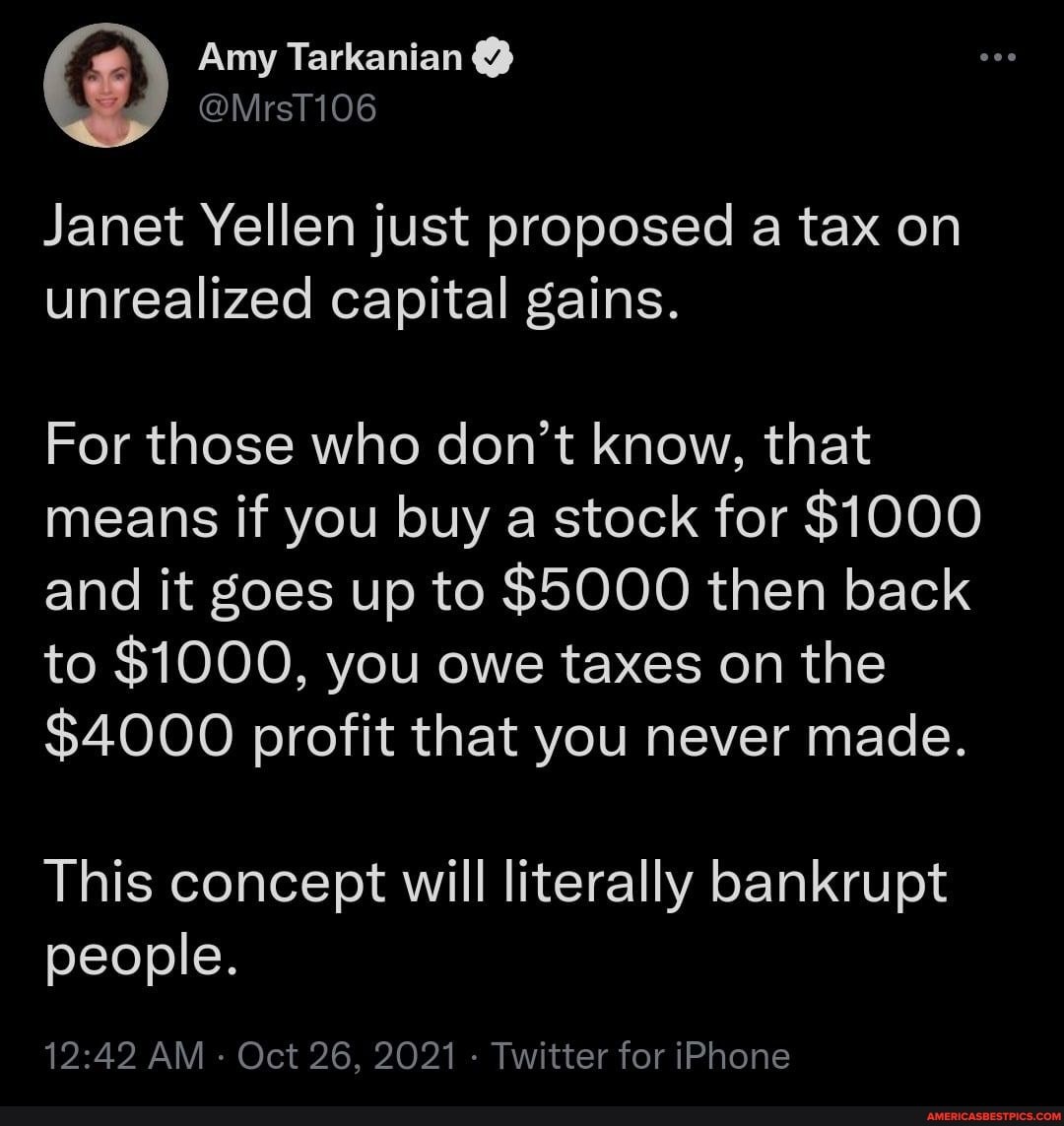

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India